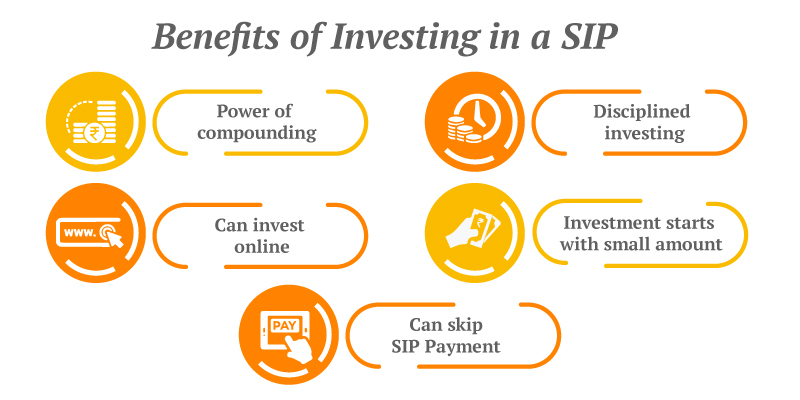

SIP is one of the best options to put their money as it mitigates the risk of a potential market crash for those who have just entered the world of investment.

Without any hassle, every month SIP allows investors to put in smaller amounts. One can also give Standing Instructions (SI) to the fund house for auto-debit from your bank account.

Your returns multiply by compounding interest is one of the biggest benefit of investing in the mutual fund via SIP i.e. you earn interest on the principal amount and the interest gained on that amount. For eg: If you invest Rs 1000 in a mutual fund at a 10 percent rate of return then the interest earned would be Rs 100 after a year. You’ll earn interest on Rs 1,100 from the next year.